Hey everyone, I’m Jeff and thanks for reading Second Generation — a bi-weekly1 newsletter where I share my evolving thoughts on wealth from the perspective of a first-generation college graduate.

I hope you enjoy the content 🙏🏼

TL;DR

Previously, on Second Generation: Wealth From the Ground Up 👈🏼

All of us were passed down some form of the American dream, but achieving the things on our lists won’t always make us happy. Oftentimes, what we really want is financial security.

Money is part of everyday lives and flows through our socioeconomic system. Wealth is about having stake in the financial infrastructure by supporting what already exists, creating new value channels or making the system better as a whole.

Choose your own adventure — invest in what works today, create what could be better, and/or rearchitect what wealth looks like.

Next steps: Betterment for passive investing, Wealth shown to scale, Chamath Palihapitiya on Money and Business Models Aren’t Just For Business.

Our Origin Story ⬅️

When I was growing up, my parents never talked about wealth — it was always about money.

They were focused on paying the bills and putting food on the table. They didn’t have the time or energy to sit down, and just think about “what wealth means” like I have the privilege of doing today. All they had was a dream.

The American Dream

It was the dream all our parents passed down to us at one point or another. They told us that even though succeeding was hard, success was just a matter of following a few simple steps:

Graduate college ✅

Get a “good” job ✅

Buy a house ✅

Live happily ever after 🎉

In essence, it’s the reason we call ourselves “first-generation college graduates” to begin with. This dream was our guiding light and, at least for me, a big part of why I am where I am today.

But it's far from perfect. College challenges our ideals when we realize just how much we don’t know and now, two years out of college myself, I can attest to the fact that even getting that good job or buying a house doesn’t always make us happy.

Now What?

Over the coming weeks, I want to kick off the Pillars of Wealth by talking about financial security — the peace of mind that we’re often looking for when we think about wealth (spoiler alert: it was never really about the money).

For today’s issue, we’ll start with understanding how money works and why we need to differentiate it from wealth in order to obtain financial security.

Building Wealth 💸

Having money is pretty transparent — we can just check our wallets or pull out our phones and log into our bank accounts — but wealth is harder to see. It’s systemic, cultural and a reflection of our financial infrastructure.

In actuality, wealth is about consistently influencing money flows.

Money Flows

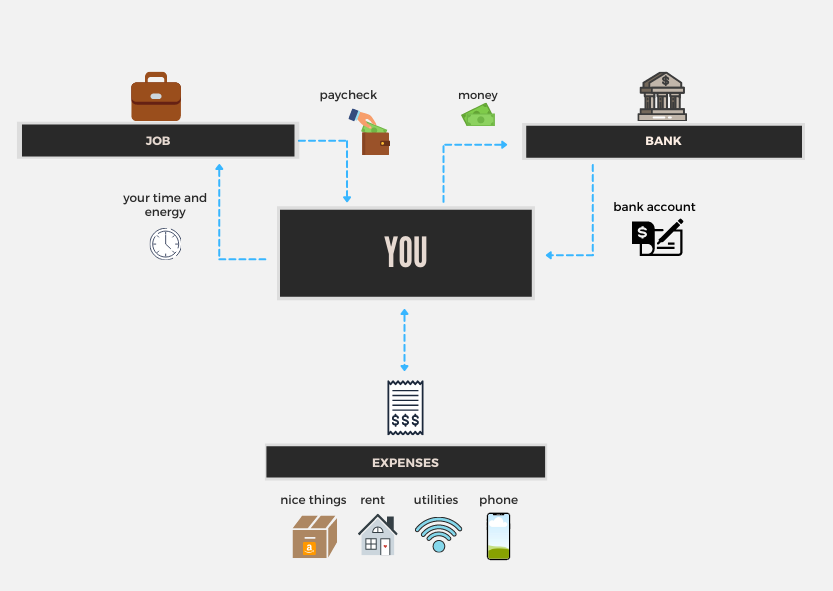

Money is part of our everyday lives. We earn it from our jobs, spend it on the things we want and save some of it to spend later.

In this sense, money’s value is clear (we give X dollars in exchange for Y) and transient, (once we give it in exchange for something else, it’s value to us is gone).

But the purpose of money extends beyond our own, isolated financial decisions.

Money we earn is someone else’s expense, money we spend is probably going to Amazon and the money we put in our bank accounts doesn’t actually just sit there. It constantly moves between people, businesses and governments at scale and effectively serves as a common language to communicate value.

In other words, every financial decision sets off a chain reaction of socioeconomic activity where money inevitably leaves our immediate control and becomes subject to the invisible forces of our existing financial infrastructure.

Wealth is about having stake in this financial infrastructure — whether that’s in the form of financially supporting what already exists, creating new value channels that others can benefit from or doing the work that’s necessary to make the system better as a whole.

Wealth Influences The Current

If the ebb and flow of money is like water, then building wealth is analogous to its current — shaping the volume and direction of money throughout our socioeconomic system.

The way I see it, there are three broad paths we can take to turn our money into wealth that are all equally valuable and depend on each other:

Invest in what works today: Whether you want to support your community or just get a piece of the profit pie yourself, every financial decision is your chance to influence the money flow (no matter how slight). Like the plumbing that guides the running water in our homes, existing financial organizations are rigid, but effective.

Create what could be better: We can create what we know will be valuable — i.e. start something people are willing to pay for. If we notice the plumbing is broken, we can take the high-risk, high-reward path and try fixing it ourselves. It’ll be messy, but some of us will just prefer to create these things ourselves and, if it works, we gain wealth from capitalizing on an opportunity to create.

Rearchitect what wealth looks like: Now, there comes a time when the system itself is part of the problem — and that’s to be expected! Our financial system is far from perfect, but it’s important to remember that people are ultimately what legitimize value. If new systems are imagined, created, and adopted by everyone else, then those who were there to lay the groundwork of these new systems2 would be, by definition, wealthy.

So as to not go on a separate tangent here, I’ll unpack these a little more in a later issue.

Next Steps 🛠️

Our system is, without a doubt, an imperfect one, but change starts small. Below is a shortlist of resources that I’ve found particularly helpful in my journey so far; I hope they prove useful to you too:

Practical Resources

Betterment: Investing on auto-pilot — Betterment is a “robo-advisor” that I personally use to regularly invest in things like my Roth IRA.

Robinhood: The technology-first investment platform — Robinhood helped ease me into the world of investing in stocks and I consider it an essential (and easy) tool for every newbie.

Coinbase: Crypto is the future, but damn is it complicated — Coinbase may not be a perfect final destination for cryptocurrency investing, but it’s the best first step into this new world.

Further Reading

Wealth, shown to scale: An incredible visualization of wealth that not only provides countless research-driven insights about the concentration of wealth, but does so in a way that speaks volumes.

Chamath Palihapitiya on Money: One of my favorite talks on the topic of money and wealth. Chamath Palihapitiya speaks to how we can understand money as an instrument of change and Silicon Valley’s failure to cultivate meaningful value.

Business Models Aren’t Just For Business: Why don’t we talk about business models outside of the workplace? If you want to sustainably help the people you care about, you need to figure out how you’re going to systematically deliver value to them. That’s what a business model is for.

Moving Forward ➡️

While the American dream is both inspiring and comforting, its’s also limiting to those of us that are may not quite fit within each checkbox. Maybe we’re struggling through our college classes, still figuring out what career we want to pursue or aren’t ready to settle down and buy a house.

Building wealth is about more than just having money. We use money within a living, breathing financial system where people are the ones that decide what’s valuable and wealth comes from being intentional with our money and facilitating how value is created and re-distributed.

Reframing our rigid set of goals into a flexible understanding of financial security will serve as a bridge between generational ideals around success — and I hope you’ll join me on that journey.

Coming Up

Choose Your Own Adventure: the different ways to build wealth

When Have We “Made It”: the limits of delayed gratification

Having a Flexible Roadmap: creating a personal financial system

The Meritocracy Trap: why hard work alone isn’t always enough

Wealthy But Guilty: a short note on ethical wealth creation

Stay tuned!

— Jeff

I know it’s been a while since my last issue! Thank you all so much for sticking around. Second Generation is a work in progress and I’m learning these things as I go. From now on though, you can expect issues every other week

My bet is that cryptocurrencies and/or decentralized technologies is the frontier to be on the lookout for here.